Is Buy and Hold Dead? 🤔📈

- Gabor Fogarasi

- Jul 8, 2025

- 2 min read

Updated: Dec 8, 2025

The markets are giving us mixed signals right now! $TSLA (Tesla Motors, Inc.) down 20% while $NVDA (NVIDIA Corporation) hits new highs, and $SPX500 (SPX500 Index (Non Expiry)) showing major concentration risk. Time for a reality check on investment strategies 💭

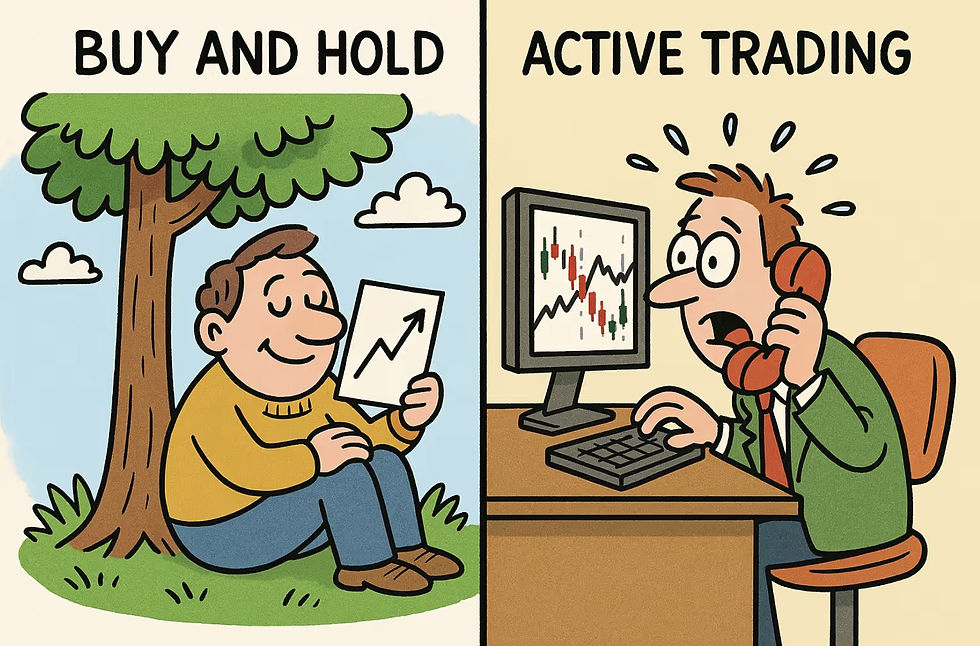

Buy and hold has been the golden rule for decades - put your money in $VOO (Vanguard S&P 500 ETF) and forget about it. But 2025 is testing this approach like never before! 🔥Or is it?

What's Changed?

The traditional buy-and-hold approach assumes markets will always trend upward over time. But we're seeing warning signs everywhere - tech valuations at bubble levels, consumer sentiment tanking, and the dollar weakness putting pressure on US assets.

Humans also tend to see a pattern in everything. Yes, headlines always scream the end is near! We just tend to forget about them over time. If I only had a dollar for every headline predicting the greatest collapse of all time... Such a collapse rarely comes.

The Smart Money's "New Approach" 🎯

"Experts" are adapting to uncertainty with hybrid strategies. Instead of pure buy and hold, consider a "core and satellite" approach - keep 70-80% in stable positions like $BTC (Bitcoin) and $VTI (Vanguard Total Stock Market ETF) , then actively manage 20-30% based on market conditions.

Well, nothing new here, this strategy is decades old, but you can always tout it as a "new" strategy, in "response" to current market uncertainties. Don't get me wrong, it is a valid strategy, lowering risk. It's just not new.

I let you in on a secret: There was never a time in history with market certainty. Volatility is part of the game, on the stock market; whenever you make a transaction, it means there is another investor on the other side of that trade, who thinks the complete opposite. And you are both happy making the trade.

Buy and hold isn't dead; it's just that new traders struggle to understand what long-term is. Trump's lunatic approach created volatility, but in a few years, nobody will remember those. Just a small dip in the chart. The markets reward those who are patient.

In this environment, copying experienced traders who navigate both bull and bear markets becomes more valuable than ever. Who doesn't panic sell, and doesn't sell winners early.

💚 I'm Gabor Fogarasi - I Don't Work for Money, Money Works for Me.

🔄eToro’s CopyTrader feature lets you automatically mirror my Strategy🚀

✅2023 - 54.58%

✅2024 - 54.1%

Gabor Fogarasi @fogi70

eToro Popular Investor 🏦

CISI Level3 Investment Certification

Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk.